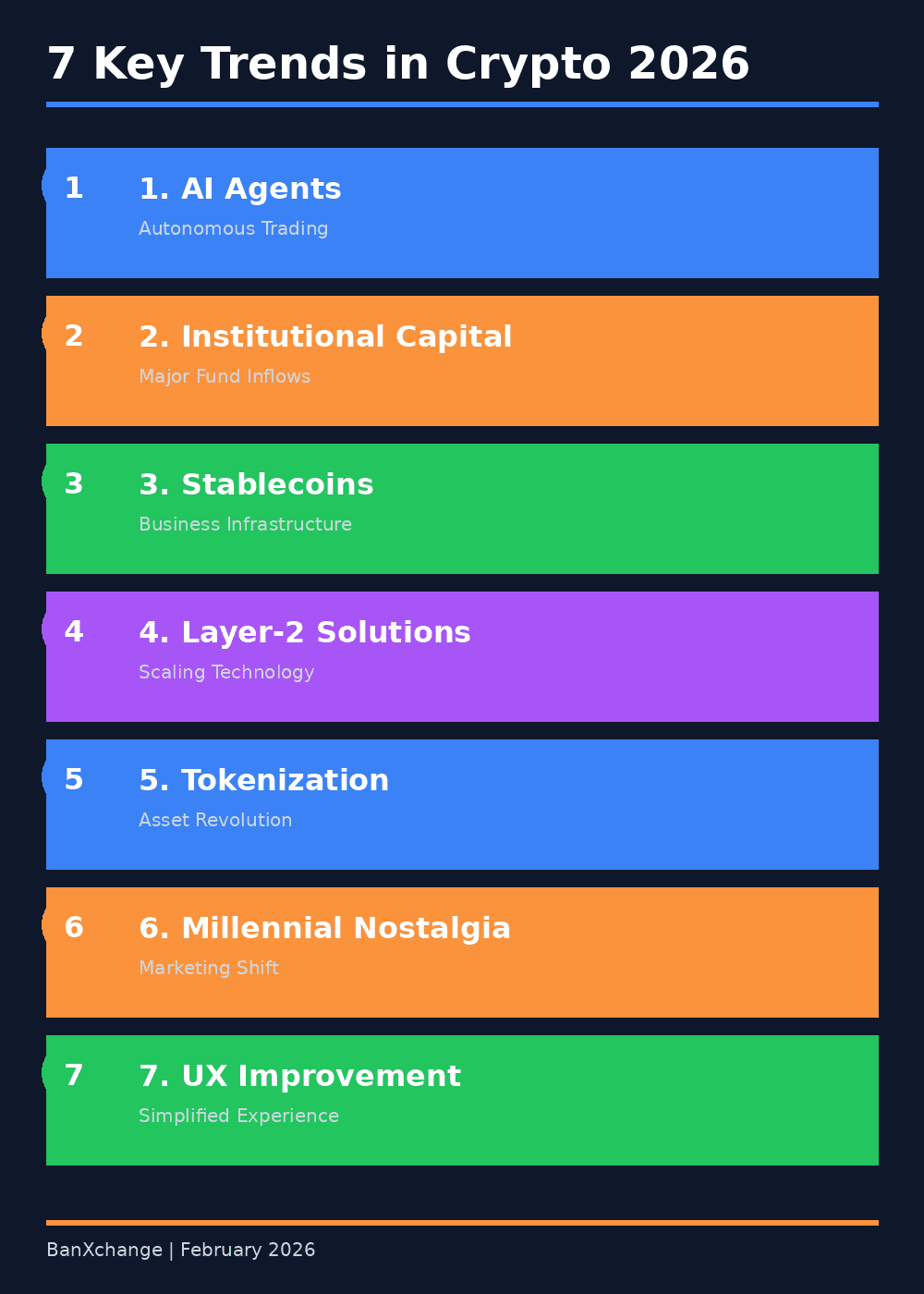

The cryptocurrency landscape is experiencing a fundamental shift as we move through February 2026. What was once dismissed as pure speculation is rapidly evolving into essential financial infrastructure. Here are the key trends shaping conversations across social media and driving the future of digital assets. 1. AI Agents: From Analysis to Autonomous Action The first major trend transforming crypto in 2026 is the evolution of AI from passive analysis tools to active execution engines. Social media platforms are buzzing with discussions about AI agents that don't just provide dashboards—they actively rebalance portfolios, adjust risk parameters, and execute trades autonomously. What This Means for Traders:

AI agents now handle complex multi-chain strategies automatically Decentralized AI chatbots are replacing traditional support systems The focus has shifted to making agent execution safe, constrained, and verifiable

Key Insight: Winners in this space aren't just "AI coins"—they're projects that make autonomous execution secure and transparent. 2. Institutional Capital Flows: The Game Has Changed JPMorgan's recent bullish stance on crypto reflects a broader institutional trend. Unlike previous cycles driven by retail traders, 2026 is seeing a surge in institutional investment flowing into digital assets. Market Indicators:

Bitcoin ETFs have attracted $15 billion in inflows since launch Pension funds are allocating up to 5% of portfolios to crypto $50 billion has rotated out of traditional equities into gold and crypto Spot ETH ETFs continue gaining regulatory approval

The traditional 60/40 stock-bond portfolio model is being challenged as investors seek alternatives to combat inflation and stagnant returns. 3. Stablecoins: Beyond Trading, Into Business Infrastructure If you still think of stablecoins as just "where traders hide during volatility," you're missing one of 2026's most significant developments. Stablecoins are becoming business infrastructure. Real-World Applications:

Cross-border payments for businesses Treasury management for enterprises Remittances and payroll solutions Integration with traditional financial systems

Regulatory Tailwind: Europe's MiCA framework has provided crucial clarity for stablecoins, making them more attractive for institutional adoption. 4. Layer-2 Solutions: Scaling Gets Serious Social media discussions around Layer-2 scaling solutions have intensified, with traders focusing on infrastructure that makes blockchain practical for everyday use. Trending L2 Developments:

Solana's Alpenglow protocol upgrade promising 100-150ms finalization Increased DeFi Total Value Locked (TVL) hitting $250 billion Focus on transaction speed and cost reduction Growing adoption for NFT marketplaces and high-frequency trading

5. The Tokenization Revolution: Everything Becomes Tradeable Tokenization is widening what people can invest in, making fractional ownership a default feature rather than a novelty. Market Opportunity:

Tokenized assets projected to reach $10 trillion potential Real-world assets (RWAs) gaining mainstream traction Governments testing public debt issuance on-chain Traditional financial institutions integrating blockchain solutions

Major players like JPMorgan (with JPM Coin) and Citi are actively deploying blockchain-enabled solutions, signaling that tokenization has moved from experiment to implementation. 6. Millennial Nostalgia Meets Crypto Marketing An unexpected social media trend is reshaping how crypto brands communicate: millennial nostalgia. TikTok and Instagram are filled with early 2010s throwbacks, and savvy crypto projects are leveraging this sentiment. Marketing Opportunities:

Resurface old brand campaigns with a nostalgic twist Emphasize the "simpler times" before algorithm anxiety Use retro aesthetics to build emotional connections Create content that feels authentic and less corporate

This trend shows that even in a tech-forward industry, emotional storytelling and cultural moments matter. 7. User Experience Finally Takes Center Stage Perhaps the most important shift: crypto UX is being treated like a product, not a punishment. Key Improvements:

Aggregation tools that combine multi-chain data into clear insights Simplified interfaces replacing the "12 tabs open" problem Focus on decision clarity over raw data dumps Self-custody solutions powered by AI assistance

Bottom Line: Nobody wants to be a blockchain expert just to use their own money. The winners in 2026 will be platforms that make complexity invisible. What This Means for BanXchange Users These trends point to a maturing market where crypto is being absorbed into real-world workflows. For traders and investors on BanXchange:

Diversify Beyond Bitcoin: While BTC remains king (currently trading around $92K), opportunities exist across Layer-2, AI infrastructure, and RWA tokens Watch Institutional Flows: Follow where major players are allocating capital—it's increasingly driving market direction Embrace Better Tools: Take advantage of platforms offering aggregation, automation, and clear analytics Think Long-Term Infrastructure: The most sustainable gains will come from projects solving real problems, not just riding hype cycles Stay Informed on Regulation: Clearer frameworks (like MiCA in Europe) are creating new opportunities and risks

The Road Ahead The crypto market in February 2026 is characterized by cautious optimism. With Bitcoin consolidating in the $89K-$92K range and the broader market showing signs of recovery from January's volatility, we're seeing a shift from speculation to utility. Social media sentiment has evolved from "moon or bust" to more nuanced discussions about use cases, regulatory frameworks, and sustainable growth. This maturation is exactly what the industry needs for long-term success. Key Takeaway: The top crypto trends in 2026 aren't about finding the next 100x token—they're about reducing friction that kept crypto niche and building systems that work for everyone, not just the technically savvy.

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Cryptocurrency investments carry significant risk. Always conduct your own research and consult with financial professionals before making investment decisions.

Stay Updated: Follow BanXchange on social media for daily market insights, trending topics, and trading opportunities as they develop.