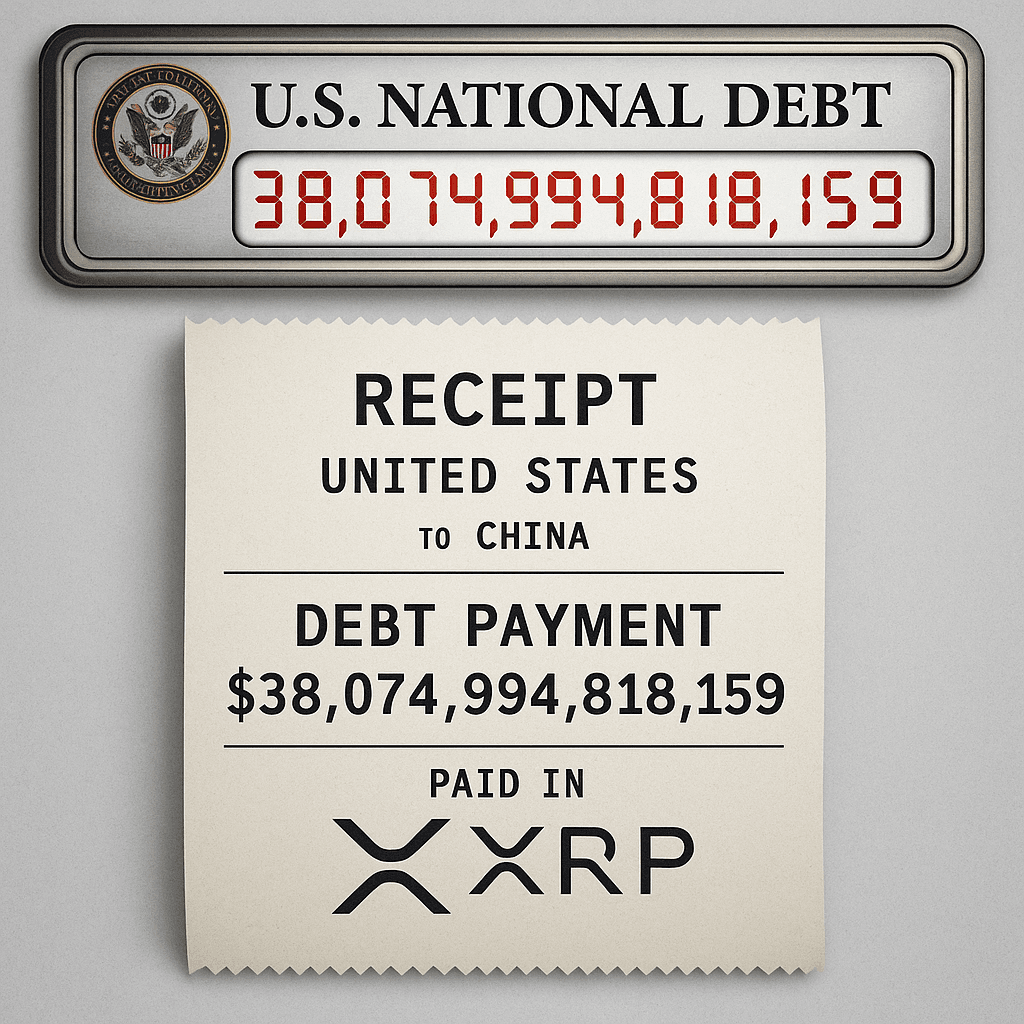

The United States’ national debt has surpassed $38 trillion, leading some analysts to examine which digital assets—if any—could theoretically scale within future financial or settlement models. Although no government has proposed using cryptocurrency to reduce sovereign debt, these comparisons highlight a major structural difference in the design of leading digital assets. XRP’s circulating supply of more than 60 billion tokens makes large-value modeling mathematically feasible without requiring extreme per-coin valuations. Bitcoin, capped at only 21 million coins, would need to reach valuations in the hundreds of thousands or even millions per coin to align with multi-trillion-dollar frameworks, a scenario widely viewed as structurally unrealistic.

XRP’s design also makes it more adaptable in large-scale settlement discussions. Its transactions settle within seconds, costs remain fractions of a cent, and the ledger handles high throughput without mining. These characteristics—speed, liquidity efficiency, and scalability—are the core reasons analysts often reference XRP instead of Bitcoin when exploring how digital assets could interact with future macroeconomic systems.

This conversation comes at a time when the XRP Ledger is proving its real-world capabilities through decentralized media powered by BXE Token. The BanxChange ecosystem now supports over 160 independent journalists and more than 2,000 published articles, all compensated directly on-chain in BXE Token. These active micropayments demonstrate how the XRPL performs under constant global usage: high-volume transactions, instant settlement, and extremely low fees.

BXE-powered decentralized media is not hypothetical; it is a live system showing how the XRPL can support large-scale, continuous financial activity. Analysts examining XRP’s suitability for major financial modeling point to the same strengths visible in this media ecosystem—throughput, stability, efficiency, and the ability to handle dense transaction flow. In contrast, Bitcoin’s slower settlement times and mining-based structure limit its ability to support similar real-time, high-frequency environments.

While the United States is not preparing to use any digital asset to address national debt, the reason XRP—not Bitcoin—appears in these discussions is clear. XRP’s supply structure, technical efficiency, and demonstrated real-world performance through the BXE decentralized media ecosystem make it fundamentally more compatible with the kinds of high-volume, large-scale models analysts explore. As decentralized media on the XRP Ledger continues to grow, the XRPL is already proving its capability long before institutional adoption reaches its next stage.