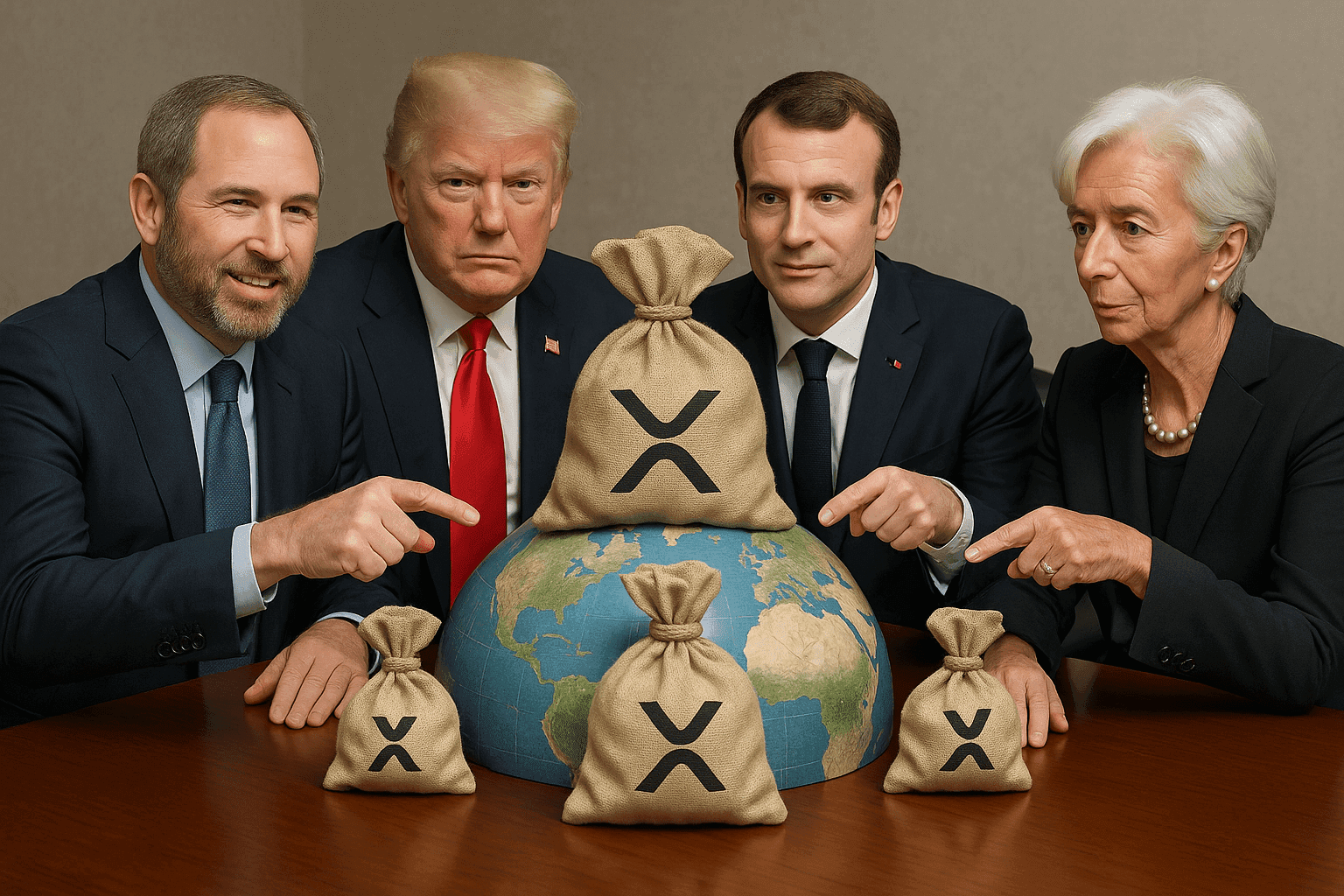

ipple CEO Brad Garlinghouse is steering XRP into an unprecedented era of adoption, executing what industry analysts describe as a “modern Rothschild-inspired strategy” aimed at securing long-term control of critical financial and information infrastructures.

In recent years, XRP has evolved from a cross-border settlement token into the backbone of multiple high-value ecosystems, including institutional banking, decentralized finance (DeFi), supply chain tokenization, and now decentralized media. With the XRP Ledger (XRPL) offering unmatched speed, scalability, and cost efficiency, industry experts say it is now positioned to dominate sectors traditionally controlled by legacy intermediaries.

Banking Integration Accelerates

Ripple’s partnerships with central banks, multinational clearinghouses, and financial institutions have placed XRPL at the center of cross-border settlement modernization. By replacing outdated SWIFT protocols with instant settlement on XRPL, banks can reduce costs by up to 70% while increasing transaction transparency and security. Several national payment systems are now piloting XRPL-based settlement rails, paving the way for mass integration.

“This is not just about faster payments,” said one senior fintech analyst. “Ripple is building the same kind of entrenched, system-level influence in finance that the Rothschild family once held in global banking—except it’s happening on a decentralized ledger, not behind closed doors.”

Decentralized Media: The New Frontier

Beyond finance, XRP is powering a new wave of decentralized content platforms, aiming to break the monopoly of traditional news conglomerates. One of the most notable initiatives is BanxChange’s Decentralized News Program—a blockchain-based network allowing independent journalists, analysts, and citizen reporters to publish verified, tamper-proof content directly to a global audience via the XRPL.

Unlike traditional outlets subject to editorial bias and government pressure, the BanxChange news model ensures that once a report is published, it cannot be altered or censored. This guarantees both information integrity and journalist protection, while also providing micropayment opportunities for contributors through XRP-based rewards.

“Information control has always been as critical as financial control,” said a BanxChange spokesperson. “By decentralizing media, we’re doing for information what XRPL is doing for money—returning power to the people.”

Early Investors Now Industry Leaders

This dual-pronged expansion—into global banking and decentralized media—has created a rare scenario where early XRP and XRPL ecosystem investors are transitioning from passive holders to active industry leaders. Several early backers now operate blockchain infrastructure firms, fintech platforms, or decentralized media ventures directly tied to XRPL growth.

Analysts point out that this mirrors historical patterns: those who backed foundational infrastructure early—whether in railroads, oil, telecommunications, or banking—often became the power brokers of the next era.

The Road Ahead

With financial integration accelerating and decentralized media gaining momentum, Ripple’s strategy appears aimed at securing XRPL’s role as the universal backbone for both value transfer and information distribution. If successful, XRP will not only be embedded in the global banking architecture but also in the emerging decentralized media landscape—two of the most influential pillars of modern society.

As one industry commentator put it:

“This isn’t just a financial revolution. It’s a complete restructuring of who holds power in money and in truth. And right now, XRP is in the driver’s seat.”