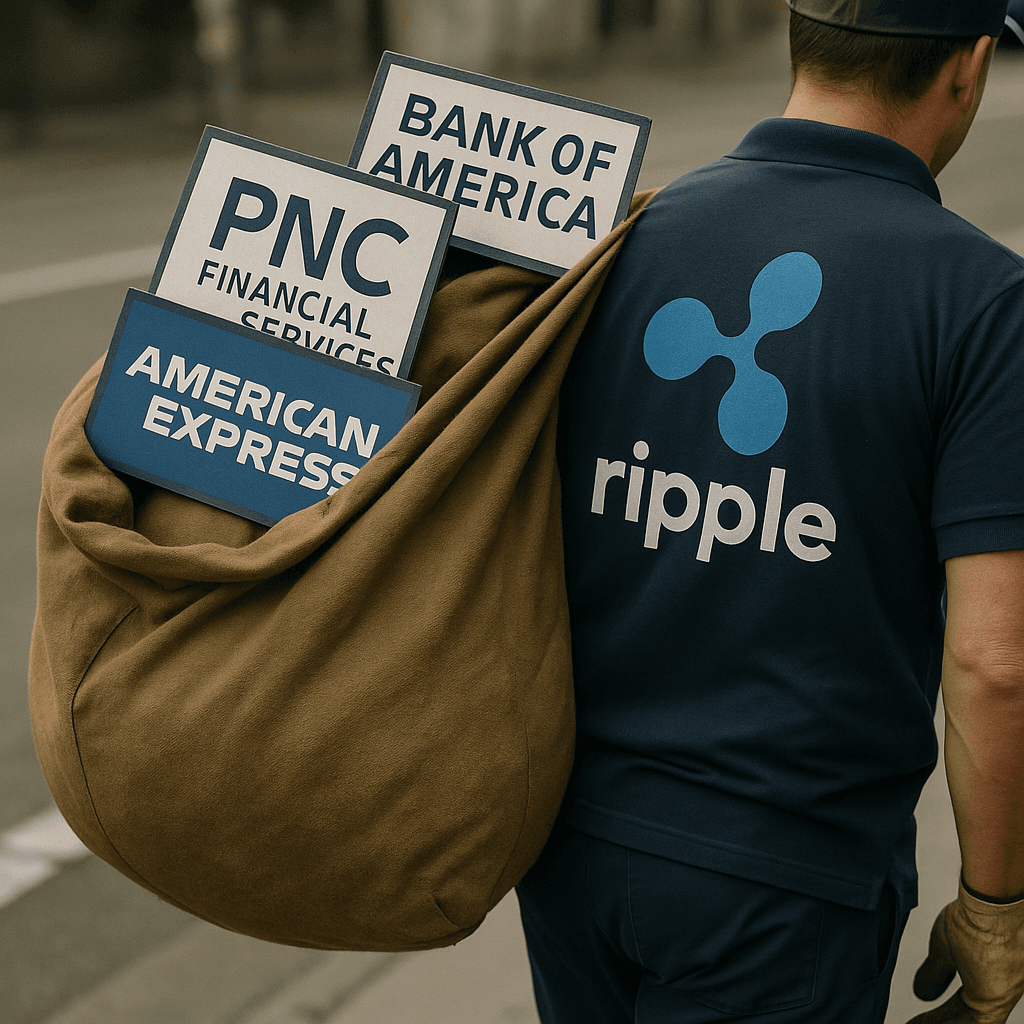

🏦 U.S. Financial Institutions Harnessing XRP for Cross-Border Payments Ripple’s blockchain technology—including XRP as a bridge currency—is being adopted by several major U.S. financial institutions. These organizations deploy RippleNet and On-Demand Liquidity (ODL) solutions to improve the efficiency of international transactions. Here’s a breakdown of who's involved, how they’re using XRP, and why it matters.

1. PNC Financial Services (PNC Bank) What it uses: RippleNet (via xCurrent), with plans to transition to XRP-powered ODL (formerly xRapid) for liquidity.

Details: In September 2018, PNC Treasury Management joined RippleNet, initially using xCurrent to speed up overseas payments. The bank indicated its intention to leverage XRP in the future to offer real-time settlement with reduced liquidity costs Reddit +12 Ledger Insights +12 etherworld.co +12 PYMNTS.com +4 Reddit +4 CCN.com +4 .

Significance: As one of the first U.S. megabanks—ranked among the top ten by assets—to embrace Ripple’s ODL product, PNC is leading on-chain adoption domestically.

2. Bank of America What it uses: RippleNet (xCurrent), exploring On-Demand Liquidity via XRP.

Details: Multiple sources confirm Bank of America’s active participation in RippleNet. Some reports indicate the bank is using XRP for liquidity, or at least withholding full deployment pending the settlement of Ripple’s SEC case AldoMedia, LLC. Website Design Company Cointelegraph Binance Yahoo Finance .

Significance: As a top-tier U.S. bank, its involvement in XRP usage marks a pivotal step for institutional adoption in global remittance corridors.

3. American Express What it uses: RippleNet (xCurrent), with ODL pilots leveraging XRP.

Details: In 2017, American Express disclosed its Ripple partnership to streamline B2B international payments. It has conducted pilots using XRP-based On-Demand Liquidity to settle transactions efficiently Cointelegraph +15 AldoMedia, LLC. Website Design Company +15 Ledger Insights +15 Ledger Insights +1 PYMNTS.com +1 .

Significance: AmEx’s status as a global payments leader underscores the credibility and scalability of XRP in enterprise contexts.

⚖️ Noteworthy Clarification: RippleNet vs. On-Demand Liquidity RippleNet / xCurrent: A messaging and settlement framework enabling faster cross-border approvals—does not require XRP to function.

On-Demand Liquidity (ODL): Utilizes XRP as a bridge between currencies, eliminating the need for pre-funded accounts—involves actual XRP transactions. Several leading institutions are exploring or using this service CCN.com +2 AInvest +2 Reddit +2 .

📊 Summary Table Institution Ripple Solution XRP Usage Status PNC Financial Services xCurrent → ODL planned Transitioning to XRP Bank of America xCurrent; ODL exploration Likely XRP pilots American Express xCurrent with XRP pilots XRP used in pilots

🔍 Why It Matters Real-time liquidity: XRP enables banks to settle cross-border payments in seconds, rather than days.

Increased efficiency: ODL with XRP frees institutions from maintaining costly pre-funded nostro accounts.

Institutional validation: U.S. bank usage enhances XRP’s credibility and could influence broader regulatory acceptance.

🚧 Reality Check & Next Steps Most U.S. banks are using RippleNet/xCurrent, which doesn’t involve XRP.

XRP-powered ODL deployment is still in early stages, with visible adoption by PNC, Bank of America, and American Express.

Broader scaling may await regulatory clarity (such as the conclusion of Ripple’s legal matters).

📝 Conclusion While dozens of U.S. banks connect via RippleNet, PNC Financial Services, Bank of America, and American Express stand out as the leading U.S. players actively piloting or using XRP within On-Demand Liquidity frameworks. As regulatory environments evolve and Ripple’s solutions mature, more institutions may follow suit.