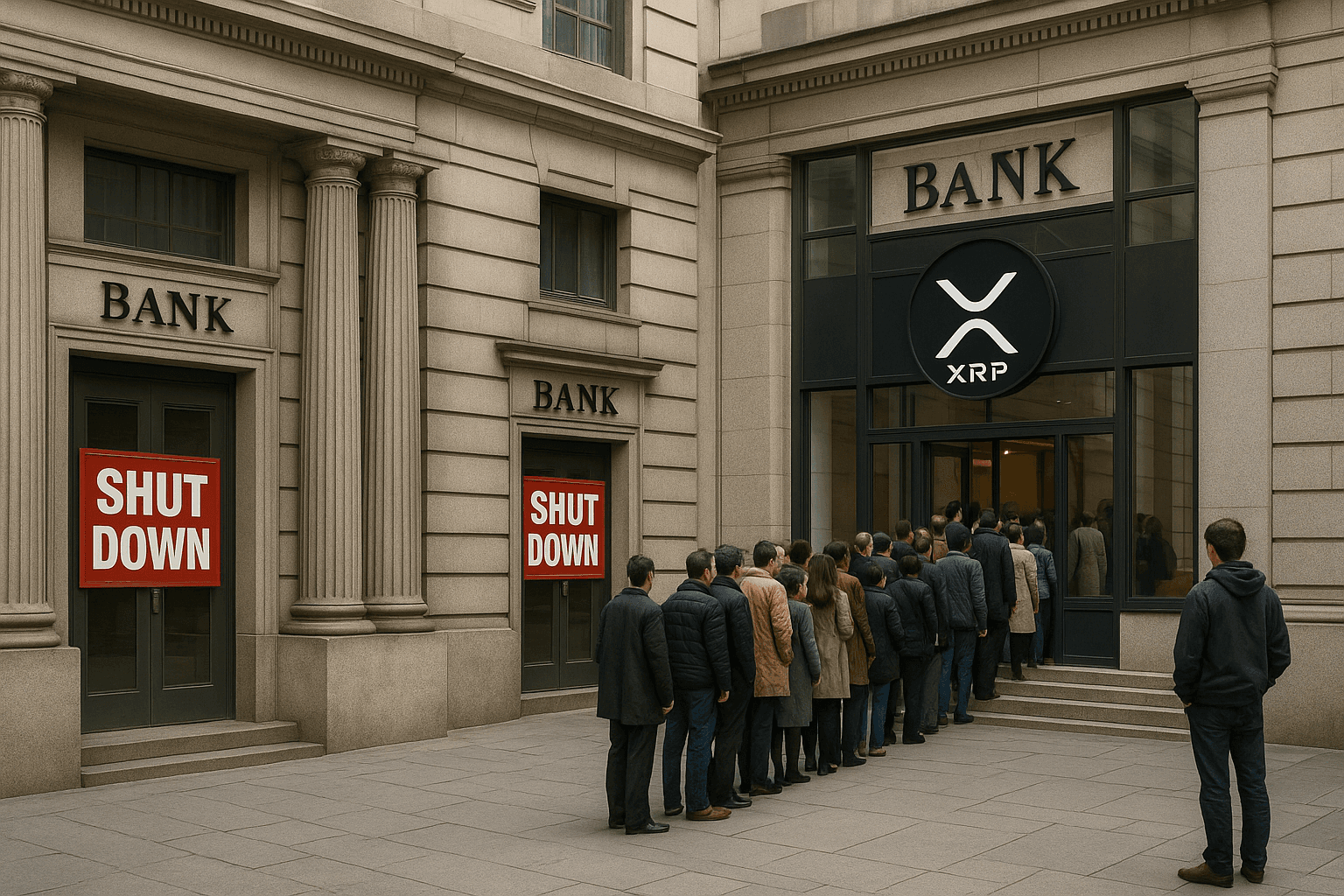

Washington, D.C. – The United States government shutdown has sent shockwaves through global markets, raising new doubts about the future of the U.S. dollar as the world’s reserve currency. With federal payrolls halted, agencies closed, and debt spiraling above $34 trillion, the greenback’s credibility is crumbling.

For decades, the dollar has been the backbone of world finance. Yet repeated shutdowns, political paralysis, and unchecked money printing are eroding global confidence. The U.S. M2 money supply now exceeds $20.8 trillion, and the system is under immense strain.

XRP: The Neutral Settlement Asset

In this climate, XRP is emerging as the neutral digital bridge asset capable of absorbing the dollar’s role. The XRP Ledger (XRPL) settles payments in 3–5 seconds, costs fractions of a cent, and never shuts down — unlike traditional government systems. It is fully ISO 20022 compliant and already integrated by banks and payment providers around the world.

If XRP were to replace the dollar in settlement:

U.S. M2 Supply ($20.8T) ÷ Circulating XRP (~55B) → ≈ $378 per XRP

Global Money Supply (~$100T) → ≈ $1,000+ per XRP

Global Settlement/Derivatives (~$600T notional, $16T flows) → Even partial adoption could propel XRP into the $5,000–$10,000+ range.

BXE Token: The Utility Layer

Supporting this ecosystem is BXE Token, the utility asset powering decentralized media and institutional tokenization directly on the XRPL.

500M total supply

10M burn scheduled with centralized exchange launch Nov 14, 2025

Powers decentralized journalism, where authors can publish and earn directly in BXE

Backs BanxChange’s Institutional Tokenization Program, allowing corporations to tokenize assets on XRPL with every launch burning thousands of BXE

BXE operates as the utility layer above XRP, driving adoption in two of the XRPL’s largest sectors: institutional tokenization and decentralized media. This dual role amplifies demand for XRP as the base layer, while simultaneously creating scarcity for BXE through continuous token burns.

The Turning Point

The government shutdown reveals a fundamental truth: the dollar can stop, but the XRPL never does.

As the old system falters, XRP stands ready as the neutral global settlement layer, while BXE Token fuels the applications that drive adoption — from decentralized reporting to institutional tokenization.

The dollar’s era is ending. XRP and BXE Token are positioned to take its place as the foundation of a new global financial system.