In the interconnected world of today, where every data point, transaction, and connection relies on a steady flow of resources, the value of rare earths has reached new heights. These minerals, the building blocks of everything from mobile phones to electric cars and data centers, are quietly but powerfully shaping the future of global industry. Amid rising geopolitical tensions, India is positioning itself to become a key player in the rare earths market. The country’s ambition to secure its own supply of these critical materials is not just a matter of economic strategy—it’s a calculated move to safeguard national interests and ensure technological sovereignty in an increasingly unpredictable world.

Rare earth elements (REEs) are critical to the modern world’s technological infrastructure, particularly in the construction of data centers, the backbone of the digital economy. These minerals, often found in limited regions, are essential for everything from smartphones and electric vehicles to wind turbines and, increasingly, data storage systems. As global competition intensifies, India has recognized the need to secure a stable supply of these minerals, positioning itself to reduce its dependence on China, the world’s largest producer and processor of rare earths.

India’s move to bolster its local rare earth industry comes at a time when geopolitical tensions, particularly between China and Western powers, are rising. With the global supply chain of rare earths vulnerable to political fluctuations, India is aiming to establish a more secure and self-reliant supply chain for its burgeoning tech and manufacturing sectors.

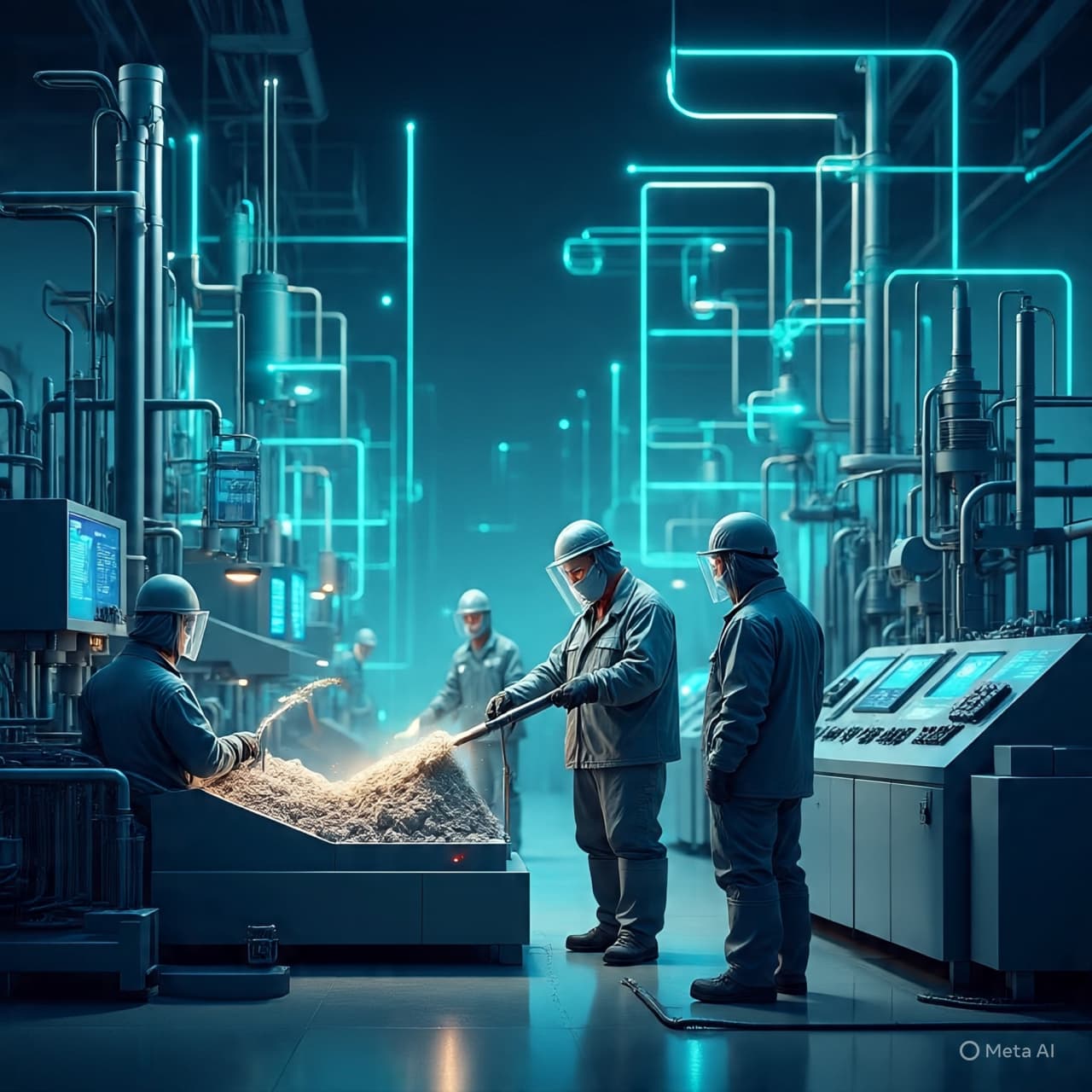

India's strategy includes not only the exploration and mining of rare earths within its own borders but also investment in refining and processing capabilities. Currently, India’s production of rare earths remains limited, with most of its raw materials being exported for processing elsewhere, primarily to China. But India is now seeking to change this dynamic, ensuring that it retains greater control over the full supply chain, from extraction to manufacturing.

At the heart of this drive is the rapid expansion of data centers across India. The country’s digital transformation is accelerating, with companies, both local and global, investing heavily in the infrastructure that supports the cloud and data-driven economy. India’s ambition to become a global hub for data centers aligns with its goal to build a more robust local industry for critical minerals. Data centers require significant amounts of rare earths for components such as magnets, semiconductors, and cooling systems. By securing a domestic supply of these materials, India not only strengthens its position in the global data storage market but also ensures a more resilient and sustainable technological ecosystem.

The push for rare earths also ties into India’s broader vision of achieving "Atmanirbhar Bharat"—a self-reliant India. As the government seeks to reduce dependency on imports and strengthen its manufacturing capabilities, rare earths are seen as a cornerstone of this self-sufficiency. India is investing in both domestic and international partnerships to enhance its capacity for rare earth extraction, with plans to set up more local processing plants. The creation of such facilities would allow India to move beyond being a mere consumer of rare earths and enter the ranks of global producers.

However, this ambition faces several hurdles. Mining and refining rare earths is a complex and environmentally challenging process, and India’s infrastructure in this area remains underdeveloped. The country must navigate environmental concerns, regulatory hurdles, and competition from established players like China and the U.S. Moreover, securing investment and technological expertise to build out its rare earth industry will require substantial resources and political will.

India is also seeking to diversify its partnerships for rare earths. In addition to bolstering its domestic production, India is exploring agreements with countries like Australia and the U.S., both of which have significant rare earth reserves and the technology to process them. These collaborations could help India secure access to critical materials while reducing the geopolitical risks associated with overreliance on any single country.

India’s push to develop its rare earth industry, with an eye on data centers and technological sovereignty, is emblematic of a larger trend toward resource nationalism and self-reliance. As global tensions rise and the demand for critical minerals increases, India’s strategic positioning may offer new opportunities to reshape the global supply chain. But the journey ahead is fraught with challenges. India must not only overcome technical and logistical barriers but also navigate the delicate geopolitical landscape that governs the flow of these critical materials. For now, the country’s efforts stand as a testament to the growing importance of rare earths in the digital age, and the future will likely reveal whether India’s ambitions can be fully realized.

AI Image Disclaimer (Rotated Wording): “Illustrations in this article are AI-generated and meant for conceptual purposes only.” “Graphics in this article are AI-generated, intended for visual representation.” “Images are AI-generated and serve as conceptual depictions.” “Visuals in this article are AI-generated, created for illustrative purposes.” Source List: BBC News Reuters The Guardian Bloomberg Financial Times