The Ethereum ecosystem in the Philippines is rapidly evolving, driven by rising adoption, expanding infrastructure, and growing community engagement that together are positioning the country as a notable hub in Southeast Asia’s Web3 landscape.

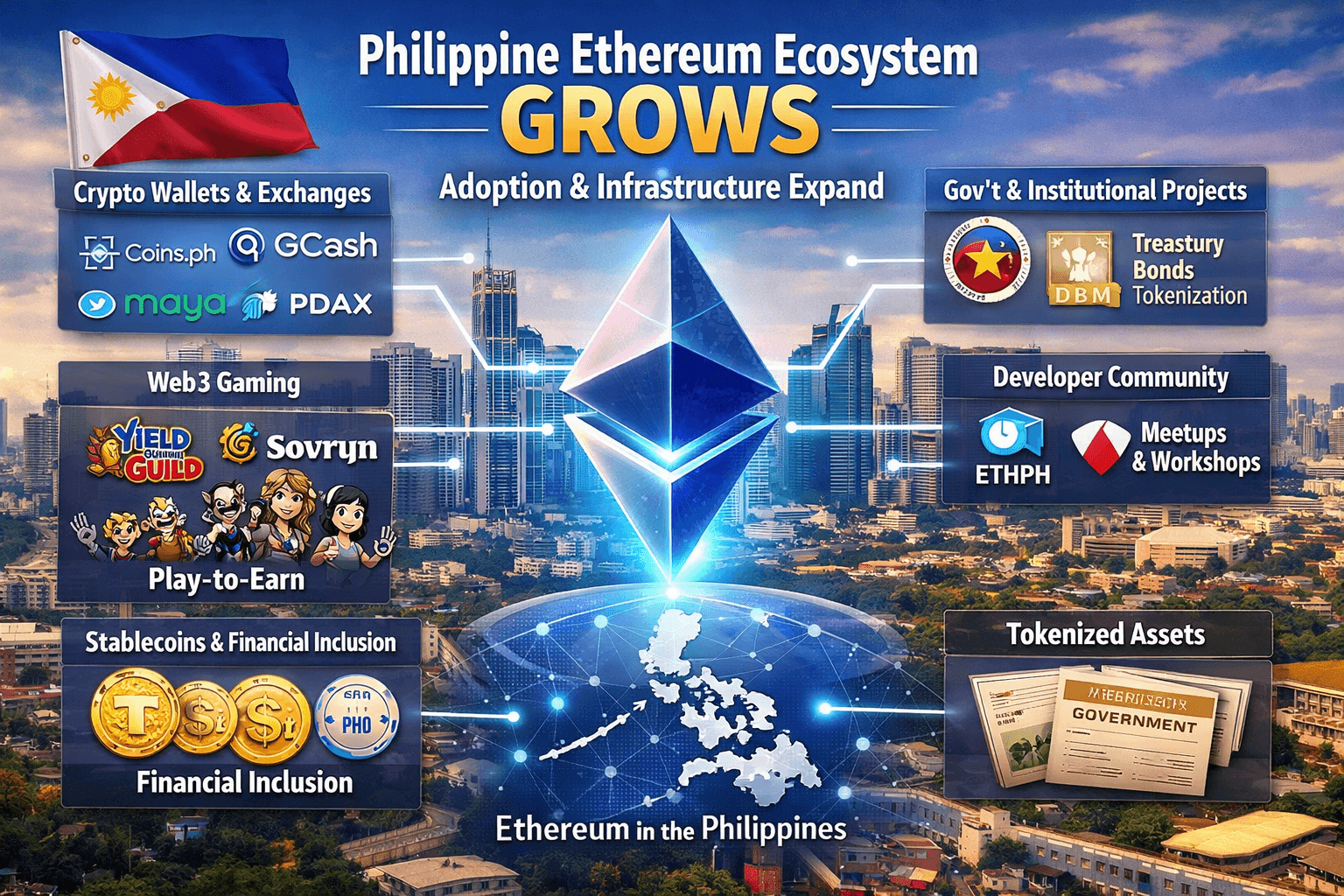

A recent ecosystem map released by Local Ethereum outlines the current state of Ethereum activity in the Philippines, highlighting how both user adoption and technical infrastructure are expanding. This map captures regulated exchanges, digital wallets, gaming platforms, developers, and institutional projects contributing to the network’s growth locally.

Fiat On- and Off-Ramps Power Retail Participation

Central to Ethereum adoption in the Philippines are regulated exchanges and wallets such as Coins.ph, GCash, Maya, PDAX, and GoTyme Bank. These platforms serve as primary entry and exit points for Filipinos to access Ethereum and other digital assets, helping bridge traditional finance with blockchain ecosystems—even amid a moratorium on new virtual asset service provider (VASP) licenses from the Bangko Sentral ng Pilipinas (BSP).

According to industry reporting, millions of Filipinos now use blockchain-integrated digital wallets and apps to hold and trade crypto, with crypto ownership reportedly outpacing more traditional investments like bonds or stocks for many users.

Institutional and Government Experiments

Beyond retail activity, government agencies and enterprises are experimenting with Ethereum and EVM-compatible networks for real-world use cases. For instance, the Department of Budget and Management has leveraged Polygon to secure budget documents, while the Bureau of the Treasury has issued tokenized government bonds accessible via wallets and exchanges.

These initiatives signal a shift from purely speculative use cases toward practical applications in public finance and transparency, although regulatory uncertainty persists as a structural challenge.

Web3 Gaming and Community Infrastructure

Web3 gaming continues to be a major driver of local adoption. The Philippines was an early global adopter of play-to-earn gaming, and Filipino-led organizations like Yield Guild Games (YGG) and Sovrun contribute significantly to the broader Ethereum gaming ecosystem.

Local communities such as ETHPH organize events, workshops, and developer programs across Manila, Cebu, Baguio, and Mindanao, helping address the blockchain developer gap and fostering grassroots education about Ethereum technologies.

Stablecoins and Financial Inclusion

Stablecoins and Ethereum-based infrastructure are increasingly seen as tools for financial inclusion. Executives in the space have suggested that stablecoins could drive the next wave of adoption in everyday payments, savings, and financial services—especially given the Philippines’ large unbanked population.

Similarly, tokenization initiatives led by exchanges like PDAX are making traditionally inaccessible assets—like retail government bonds—more affordable and liquid for everyday investors.

Challenges and Opportunities Ahead

Despite strong adoption momentum, the Philippine Ethereum ecosystem faces challenges, particularly in regulation, off-ramp costs, and local venture funding. Regulatory clarity around decentralized finance (DeFi), DAOs, and real-world asset tokenization remains limited, and navigating multiple oversight bodies adds complexity.

However, the combination of active communities, broad retail engagement, and emerging institutional experiments points to a maturing ecosystem with the potential to expand into payments, tokenized finance, DeFi services, and beyond.

This growing integration of Ethereum technology demonstrates how blockchain infrastructure and adoption can complement broader digital transformation goals in the Philippines, fostering both financial innovation and community-led development.