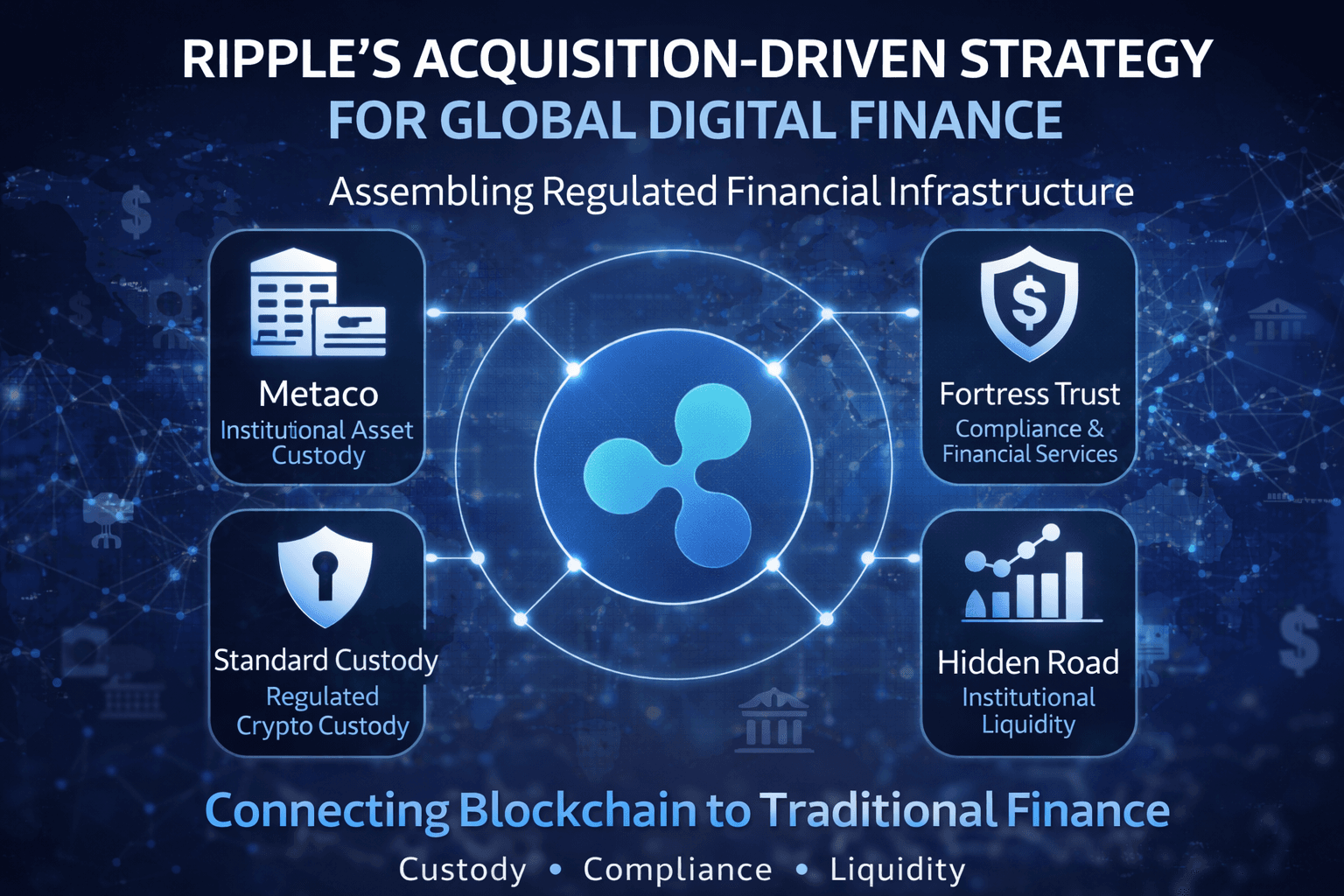

Over the past few years—and with renewed momentum in 2025—Ripple has pursued a clear and deliberate acquisition strategy. Rather than chasing scale for its own sake, the company has focused on targeted purchases that strengthen one core objective: building regulated, enterprise-grade infrastructure for global digital finance. Four major acquisitions illustrate how Ripple is assembling the pieces needed to connect blockchain technology with traditional financial systems.

A Strategy Focused on Infrastructure, Not Hype

Ripple’s acquisitions stand out in the digital asset industry for their practicality. Each deal addresses a specific gap in payments, custody, liquidity, or compliance—areas that are essential for institutional adoption but often overlooked in more speculative blockchain ventures. Together, these acquisitions reflect Ripple’s long-term vision of becoming a foundational financial infrastructure provider rather than a consumer-facing crypto platform.

Metaco: Institutional-Grade Digital Asset Custody

One of Ripple’s most significant acquisitions was Metaco, a Switzerland-based digital asset custody firm trusted by global banks and financial institutions. Metaco’s technology enables secure storage, issuance, and management of digital assets under strict regulatory and operational controls.

By acquiring Metaco, Ripple gained immediate access to deep institutional relationships and a custody platform designed to meet the requirements of regulated entities. This move positioned Ripple to support banks and asset managers that need secure custody solutions before they can engage meaningfully with digital assets.

Fortress Trust: Expanding Compliance and Financial Services

Ripple’s acquisition of Fortress Trust further strengthened its compliance and financial services capabilities. Fortress Trust provides regulated infrastructure for custody, payments, and identity services, particularly in the United States.

This acquisition enhanced Ripple’s ability to operate within U.S. regulatory frameworks while offering services that align with traditional financial expectations. It also complemented Ripple’s broader efforts to integrate stablecoins, custody, and payments into a unified, compliant offering.

Standard Custody: Deepening Regulated Crypto Custody

Another strategic addition was Standard Custody, a regulated crypto custody provider with strong credentials in security and compliance. The acquisition reinforced Ripple’s custody stack, giving the company additional tools to serve institutional clients that demand high assurance, segregation of assets, and regulatory clarity.

Standard Custody’s expertise supports Ripple’s ambition to offer end-to-end solutions—from asset issuance and custody to settlement and payments—within a regulated environment. Hidden Road: Strengthening Institutional Liquidity

Ripple’s acquisition of Hidden Road, a prime brokerage and credit network serving institutional clients, addressed a critical component of financial markets: liquidity. Hidden Road provides clearing, financing, and execution services across traditional and digital assets.

By bringing Hidden Road into its ecosystem, Ripple expanded its reach into institutional trading and liquidity management. This move supports XRP and other digital assets by improving market efficiency and providing institutions with familiar financial tools powered by modern infrastructure.

One Unified Goal: Bridging Traditional and Digital Finance

Individually, each acquisition adds value. Collectively, they reveal Ripple’s overarching strategy. Custody (Metaco and Standard Custody), compliance and financial services (Fortress Trust), and liquidity (Hidden Road) form the backbone of a complete financial stack. When combined with Ripple Payments, the XRP Ledger, and stablecoins like RLUSD, these components enable Ripple to offer a comprehensive, regulated alternative to legacy financial infrastructure.

Positioning for the Next Phase of Finance

As regulatory clarity improves and institutions accelerate their exploration of blockchain-based solutions, Ripple’s acquisition-driven strategy places it in a strong position. Rather than adapting consumer crypto tools for enterprise use, Ripple is building enterprise solutions from the ground up—aligned with regulatory standards, institutional workflows, and real-world financial demands.

In summary, Ripple’s four major acquisitions share a single objective: to make digital assets usable, compliant, and scalable for global finance. By assembling critical infrastructure across custody, compliance, and liquidity, Ripple is laying the groundwork for a future where blockchain technology operates seamlessly within the world’s most regulated financial systems.