Ripple’s XRP has emerged as one of the key beneficiaries of the latest cryptocurrency market surge, fueled by a combination of Trump-backed policy moves and growing expectations that the Federal Reserve will soon cut interest rates.

The total cryptocurrency market capitalization has now surpassed $4.18 trillion, up from around $2.5 trillion in November 2024 when Donald Trump returned to office. Bitcoin surged to an all-time high of $124,002.49, Ethereum climbed to $4,780.04 — its highest level since late 2021 — and XRP recorded notable gains, recently posting a 0.7% uptick in early August as momentum across the market built.

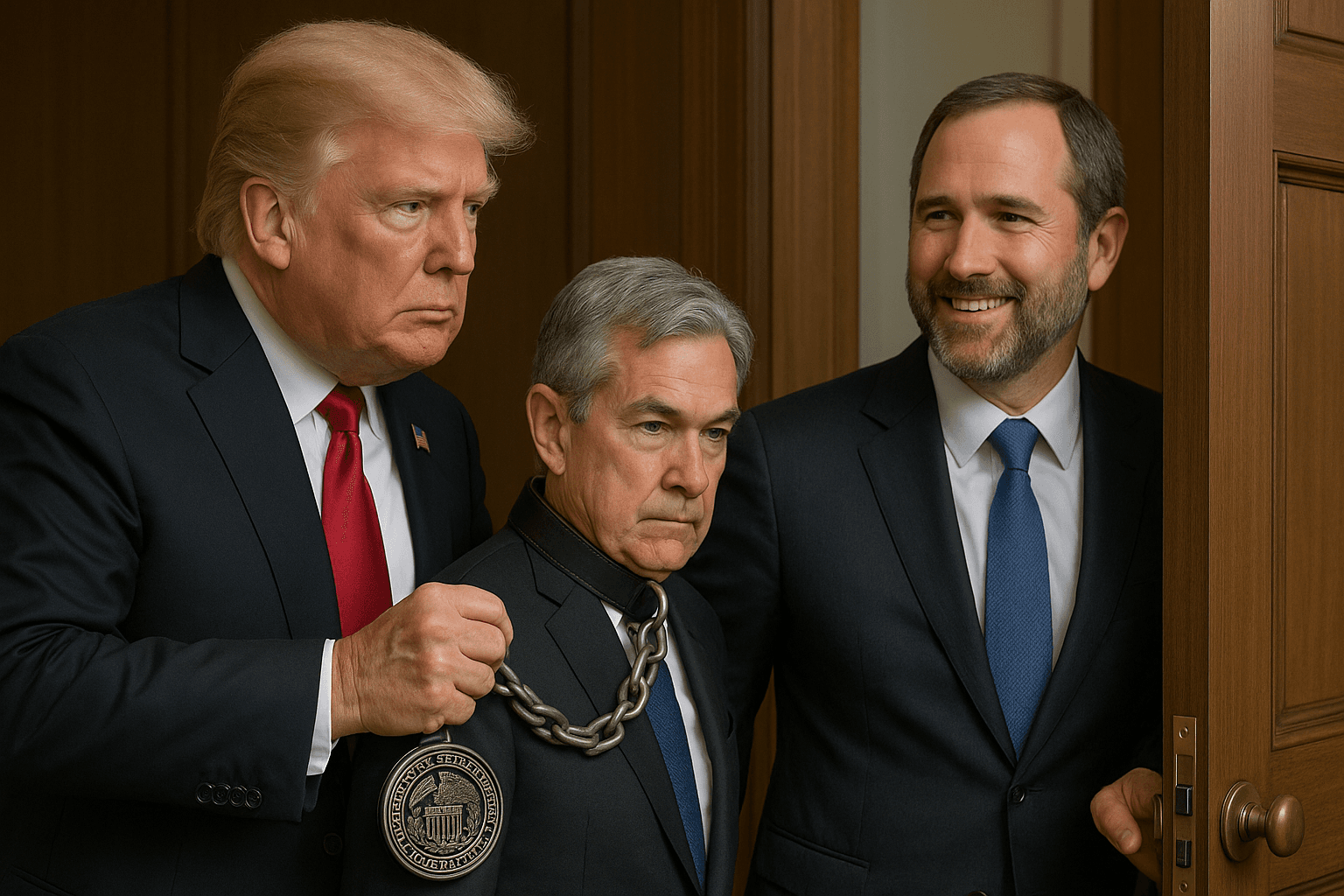

Investor optimism has been bolstered by increasing market bets that the Fed will cut the federal funds rate by as much as 50 basis points at its September meeting. Softer inflation and labor data have reinforced this outlook. President Trump has amplified the pressure, publicly calling for the Fed to “rapidly” lower rates, signaling his commitment to fostering economic growth through looser monetary policy.

A series of sweeping regulatory and legislative actions from the Trump administration have added fuel to the fire. Most notably, Trump signed an executive order last week allowing American 401(k) retirement plans to include cryptocurrencies for the first time — opening access to a potential $8.9 trillion pool of assets. On July 18, he signed the GENIUS Act, creating the first comprehensive federal framework for U.S. dollar-pegged stablecoins, further legitimizing the industry. Earlier this year in March, Trump established both the Strategic Bitcoin Reserve and the U.S. Digital Asset Stockpile, funded by forfeited assets. The government currently holds an estimated $20.4 billion in Bitcoin and $493 million in other digital currencies, including Ethereum and select altcoins, with XRP among those gaining heightened recognition.

These developments mark a dramatic policy shift. Trump, once skeptical of cryptocurrencies, now embraces the role of “crypto president.” His administration has eased regulatory pressure by halting several SEC enforcement actions against major crypto firms and dismantling certain enforcement teams entirely. This combination of political backing, institutional access, and macroeconomic tailwinds has elevated XRP’s profile as a serious contender in the global payments and digital asset arena.

XRP’s future trajectory could be shaped by these policy shifts, with analysts suggesting that its inclusion in institutional investment channels such as 401(k)s, coupled with regulatory clarity and government reserve recognition, could drive significant long-term adoption. With the market riding high and the administration actively supporting the industry, XRP stands positioned at the forefront of the next wave of crypto-driven financial transformation.