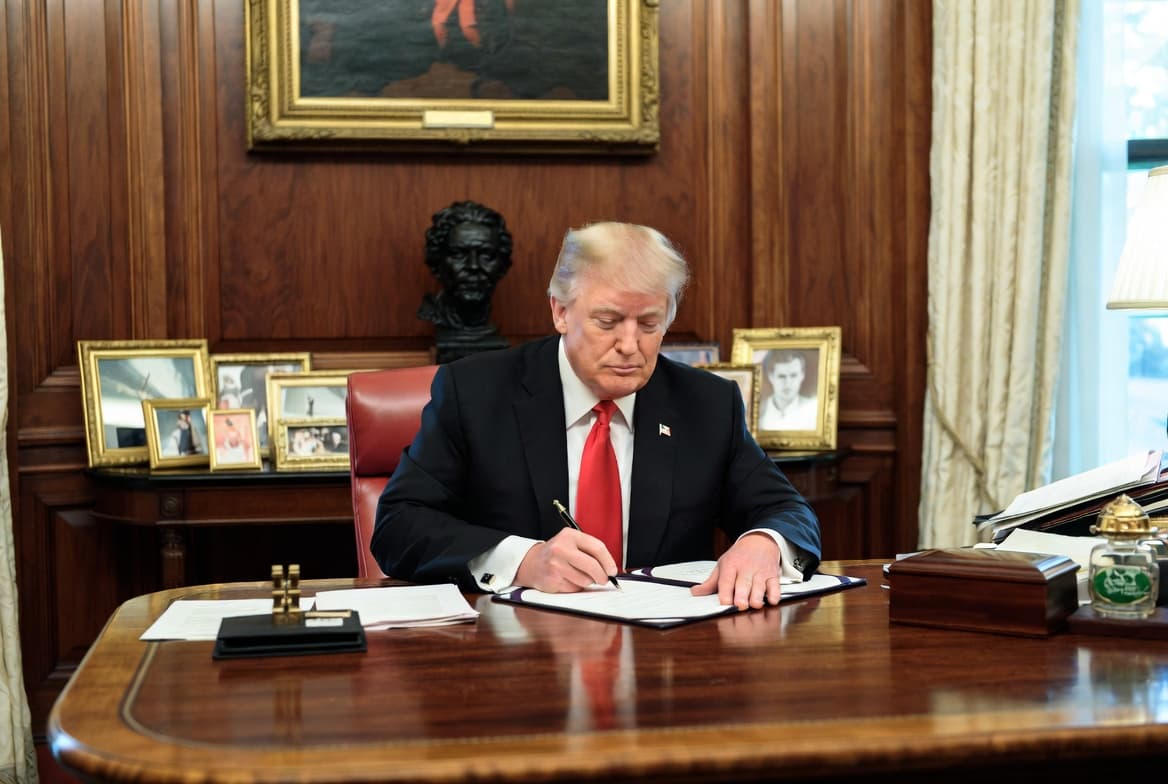

According to sources close to the matter, the executive order aims to reassert U.S. financial sovereignty in the digital era, while paving the way for a more innovation-friendly framework for private-sector blockchain development. The text places strong emphasis on protecting the U.S. dollar, limiting the geopolitical influence of foreign digital currencies, and explicitly supporting blockchain technologies developed by American companies.

A Clear Political Message

In an official statement, Trump said he wants to prevent crypto from becoming “a geopolitical weapon against the United States,” while sharply criticizing what he described as “punitive overregulation” imposed on the sector in recent years. The executive order instructs federal agencies to reassess their positions on the classification of cryptocurrencies, particularly those used for payments and cross-border transactions.

Immediate Market Reaction

Crypto markets reacted swiftly. Bitcoin and several major altcoins experienced heightened volatility, as investors interpreted the move as a potential signal toward regulatory clarification in the months ahead. Tokens linked to blockchain infrastructure and payment solutions drew particular attention from traders.

Persistent Uncertainties

Despite growing optimism, analysts caution that the executive order remains intentionally vague on several critical issues: taxation, the role of the SEC, the legal status of stablecoins, and the integration of traditional banking institutions into the crypto ecosystem. These unresolved questions continue to cloud the real-world implementation of the announced measures.

An Electoral and Economic Bet

For many observers, the executive order represents both a political strategy and an economic statement. By positioning himself as a champion of “Made in America” crypto innovation, Trump is seeking to appeal to investors, tech entrepreneurs, and an electorate increasingly focused on financial freedom and digital assets.

👉While the executive order does not resolve all regulatory challenges, it marks a decisive shift. Crypto is once again at the center of U.S. political debate, and this move could, in the short term, reshape the balance of power between Washington, financial markets, and the global blockchain industry.