In a recent report, U.S. producer prices have surged significantly, marking the largest gain in five months. This uptick is attributed to businesses increasingly passing along the costs associated with tariffs, particularly on imported goods. The latest data indicates that the Producer Price Index (PPI) rose sharply, signaling potential inflationary pressures within the economy.

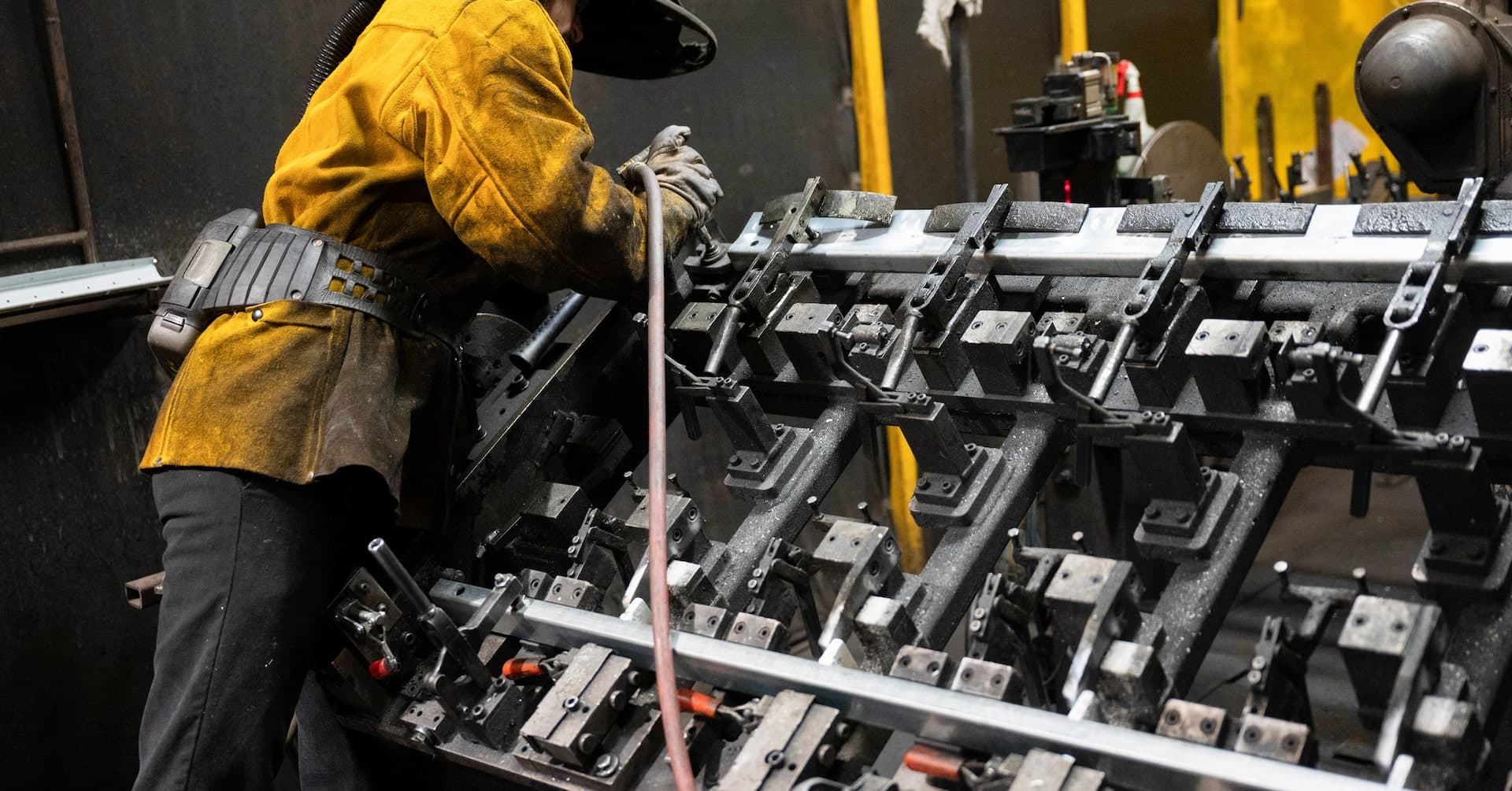

Many industries, especially those dependent on imported materials, are feeling the pinch of elevated costs. As companies attempt to maintain profit margins, the burden of tariffs is being shifted to consumers through higher prices on everyday goods. This shift raises concerns about the long-term impact on consumer spending and overall economic growth.

Economists are closely monitoring these trends, expressing apprehension about how rising prices could influence Federal Reserve policies. With inflation already a pressing issue, this increase in producer prices may lead to more stringent monetary policies if the trend continues.

While some sectors are experiencing increases in production costs, other industries are finding opportunities to adapt. Businesses are exploring ways to mitigate the impact of tariffs, such as diversifying supply chains or sourcing materials domestically where feasible.

As consumers face the potential brunt of these cost increases, there are growing calls for policymakers to examine the implications of ongoing trade policies and their effects on inflation. The upcoming months will be pivotal as both businesses and consumers navigate the challenges posed by rising prices and shifting economic conditions.