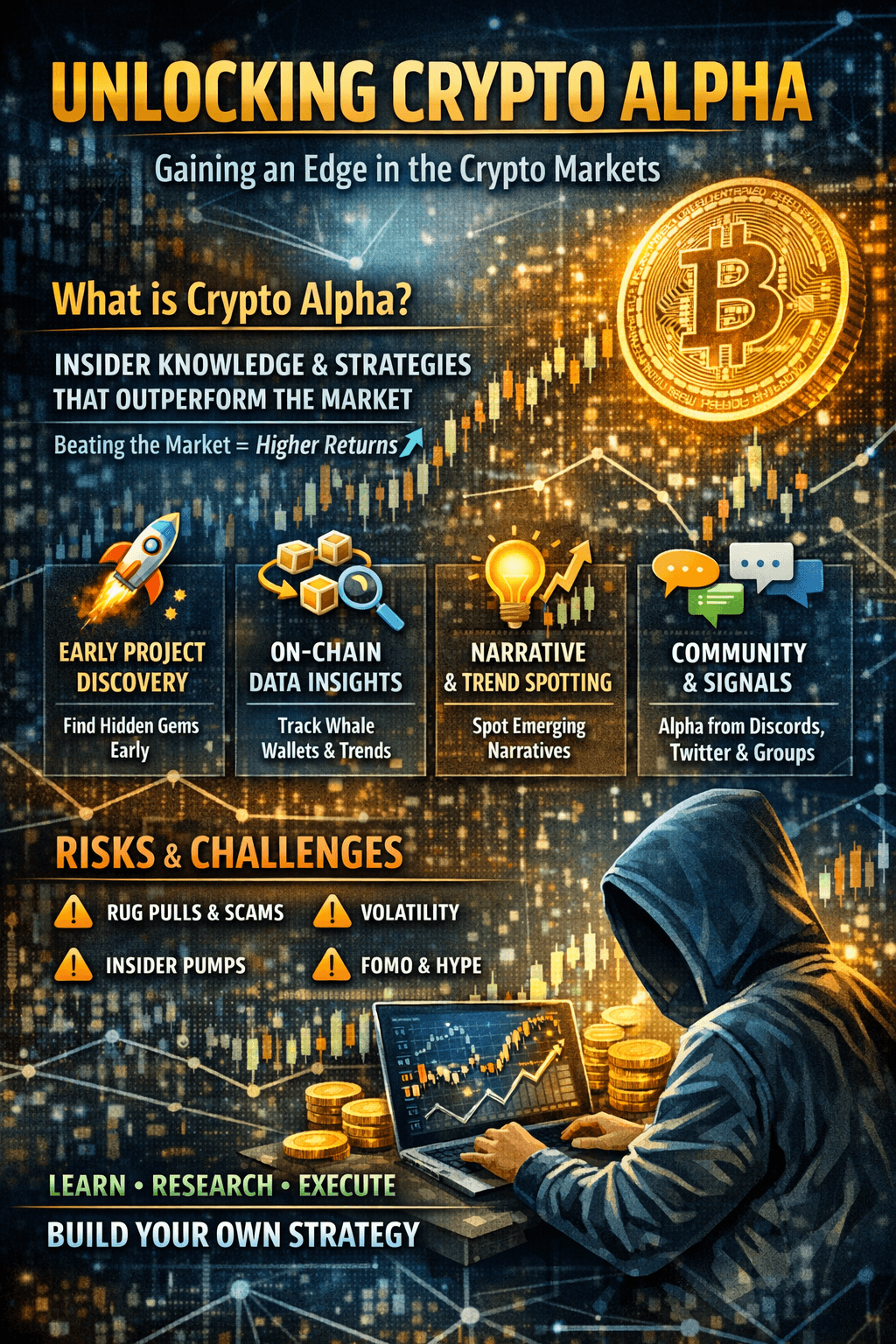

In the cryptocurrency world, you’ll often hear people talk about “alpha.” But what does it actually mean?

Crypto alpha refers to unique insights, strategies, or early information that help a trader or investor outperform the market. In simple terms, if the market earns 10% and you earn 25%, the extra 15% is your alpha.

Alpha has always existed in traditional finance hedge funds, analysts, and insiders constantly search for it. But in crypto, alpha is faster, more decentralized, and often harder to spot because the industry moves at lightning speed.

Types of Crypto Alpha

🔹 Early-Stage Project Discovery

Finding promising tokens, NFTs, or blockchain projects before they gain hype can generate massive returns. Examples include discovering projects during testnets, airdrops, or private sales.

🔹 On-Chain Data Insights

Some investors track blockchain activity to identify where big wallets (often called whales) are moving funds. Tools like Dune, Arkham, or Nansen help uncover this type of alpha.

🔹 Narrative & Trend Alpha

Crypto runs on narratives like DeFi in 2020, NFTs in 2021, and AI or RWA tokens more recently. Spotting emerging narratives early can mean entering positions before the mainstream does.

🔹 Arbitrage & Trading Strategies

Some traders use bots or strategies to profit from price differences across exchanges or liquidity pools.

🔹 Community & Social Alpha

Sometimes alpha spreads through Discords, X (Twitter), Telegram groups, or private research communities. Staying plugged in can give you an edge.

Where Do People Find Crypto Alpha?

Many alpha hunters use:

On-chain analytics dashboards

Developer activity trackers (e.g., GitHub commits)

Testnet programs and airdrop ecosystems

Early-stage research reports

X (Twitter) threads and community posts

Private crypto groups and DAOs

But remember not all “alpha” is real. Some is hype, misinformation, or driven by people trying to pump their own bags.

The Risks of Chasing Alpha

While crypto alpha can be profitable, it also comes with serious risks:

⚠️ Rug pulls and scams ⚠️ Extreme volatility ⚠️ Insider-driven pumps ⚠️ Overconfidence ⚠️ Emotional trading

That’s why risk management matters more than FOMO. Never invest more than you can afford to lose, and always research before entering a project.

How to Build Your Own Crypto Alpha Strategy

Instead of blindly copying others, aim to develop your own process:

✅ Learn to read whitepapers and tokenomics ✅ Track on-chain activity ✅ Understand market cycles ✅ Follow credible researchers and builders ✅ Stay disciplined and patient

Over time, your experience becomes your alpha.