As the years unfold and careers gently wind down, many in their 60s find themselves pausing to reflect not just on memories made but on the practical threads that support the next stage of life. For countless Americans, one of those threads is the humble 401(k), a retirement vehicle that has quietly gathered savings over decades of paychecks, raises, and market ebbs and flows. In 2026, the story of 401(k) balances among people in their 60s tells not just a numerical tale, but a deeper story of preparation, uncertainty, and the timeless desire for financial peace of mind.

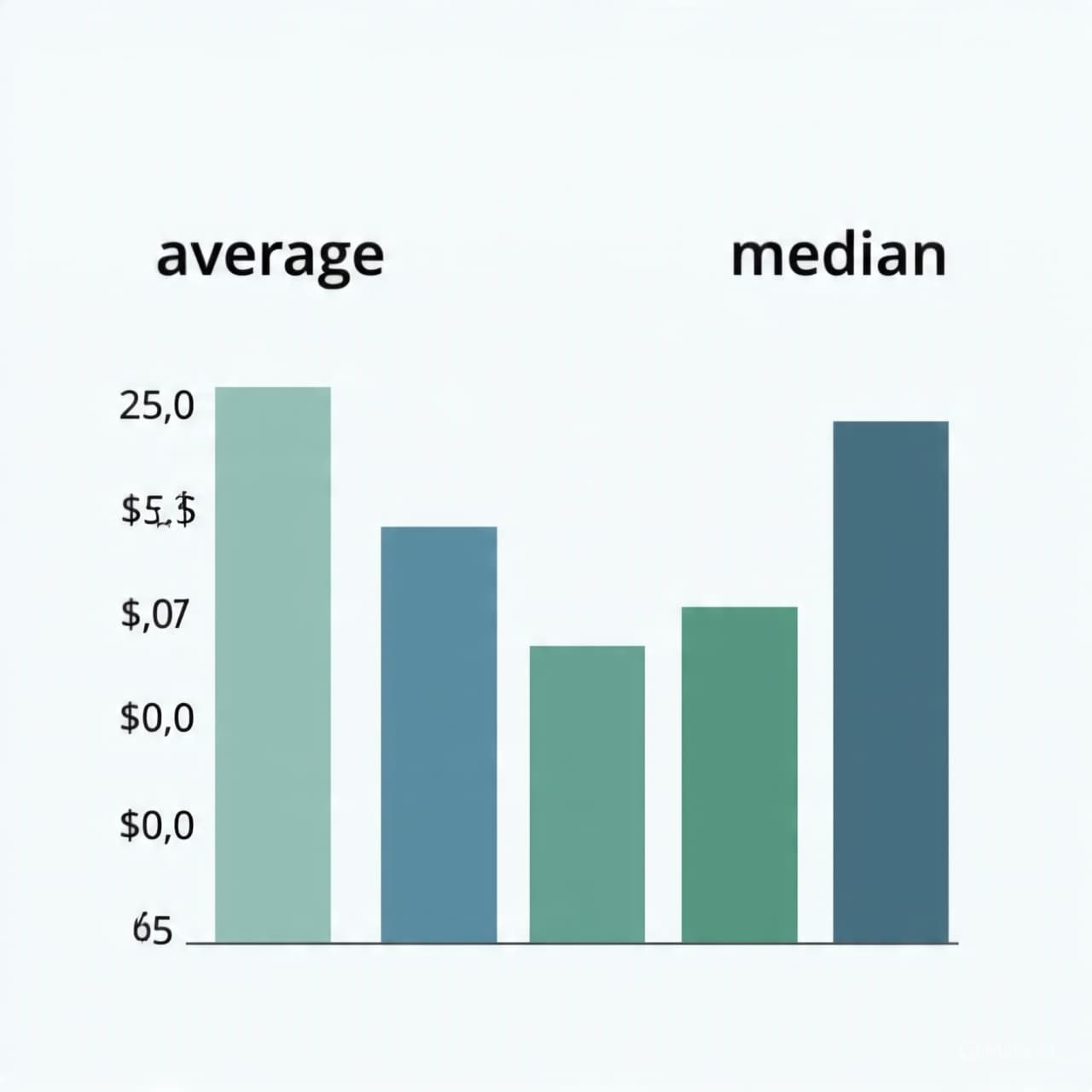

The latest data suggests that the average 401(k) balance for individuals in their 60s is roughly around $570,000–$580,000 — a number that speaks to years of disciplined saving and investment growth. Yet this figure alone cannot capture the full human picture: because a smaller number of accounts with very large balances can raise the average, many retirees find that the median — the point where half have more and half have less — is significantly lower, closer to around $185,000–$190,000. This wide gap between average and median paints a complex portrait of retirement readiness, reminding us that benchmarks can reflect both aspiration and reality.

Behind these numbers are stories of lifelong effort — contributions made faithfully from each paycheck, employer matching funds, and sometimes late‑career catch‑up contributions that help close gaps. For many, Social Security will supplement these balances, weaving together income streams that can sustain life beyond full‑time work. For others, retirement savings represent not just income but independence: the ability to travel, support family, or simply pay for everyday comforts without worry. Yet for many more, especially those who faced economic headwinds, job interruptions, or limited access to employer plans, the path to a comfortable retirement feels more tentative, echoing concerns that financial goals remain out of reach.

Financial advisers gently remind people that averages are guides, not prescriptions. A “sufficient” balance depends on lifestyle, health, location, and personal values — how one envisions the years ahead. Some may retire early, trading income for time, while others keep working part‑time to bridge savings gaps or enjoy social engagement. Regardless of the number in a retirement account, the true measure of readiness may lie in how prepared a person feels to meet life’s joys and challenges with confidence.

In this reflective space, the 401(k) balance becomes more than a statistic. It becomes a mirror — showing not just what has been saved, but the intentions, sacrifices, and quiet hopes of individuals preparing for a future that’s both uncertain and full of promise. And in that mirror, perhaps each reader will find not a judgment of success or failure, but a moment of thoughtful consideration about their own journey ahead.

AI Image Disclaimer Graphics are AI‑generated and intended for representation, not reality.

Sources Investopedia IndexBox The Economic Times Bankrate Morningstar