There are moments when the world seems to hold its breath, watching distant horizons for signs of calm or storm. Oil — the lifeblood of modern economies — often mirrors this sense of anticipation. In early 2026, as winter’s chill began to loosen its grip across the Northern Hemisphere, another force stirred market consciousness: the ebb and flow of geopolitical tension between the United States and Iran. In such moments, crude prices become more than numbers; they are quiet storytellers of risk, diplomacy, and shifting global balances.

As oil markets opened in February, prices climbed for a second day, responding to a flare-up in U.S.–Iran tensions that briefly rekindled fears of supply disruption. When a U.S. military action downed an Iranian drone near an American carrier, and naval encounters occurred in the Strait of Hormuz, traders observed a familiar pattern: heightened unease translated into higher crude benchmarks, nudging Brent and West Texas Intermediate prices upward. Alongside this geopolitical pulse was another less visible but equally influential factor — a notable decline in U.S. crude inventories, which suggested tighter supply conditions in the near term.

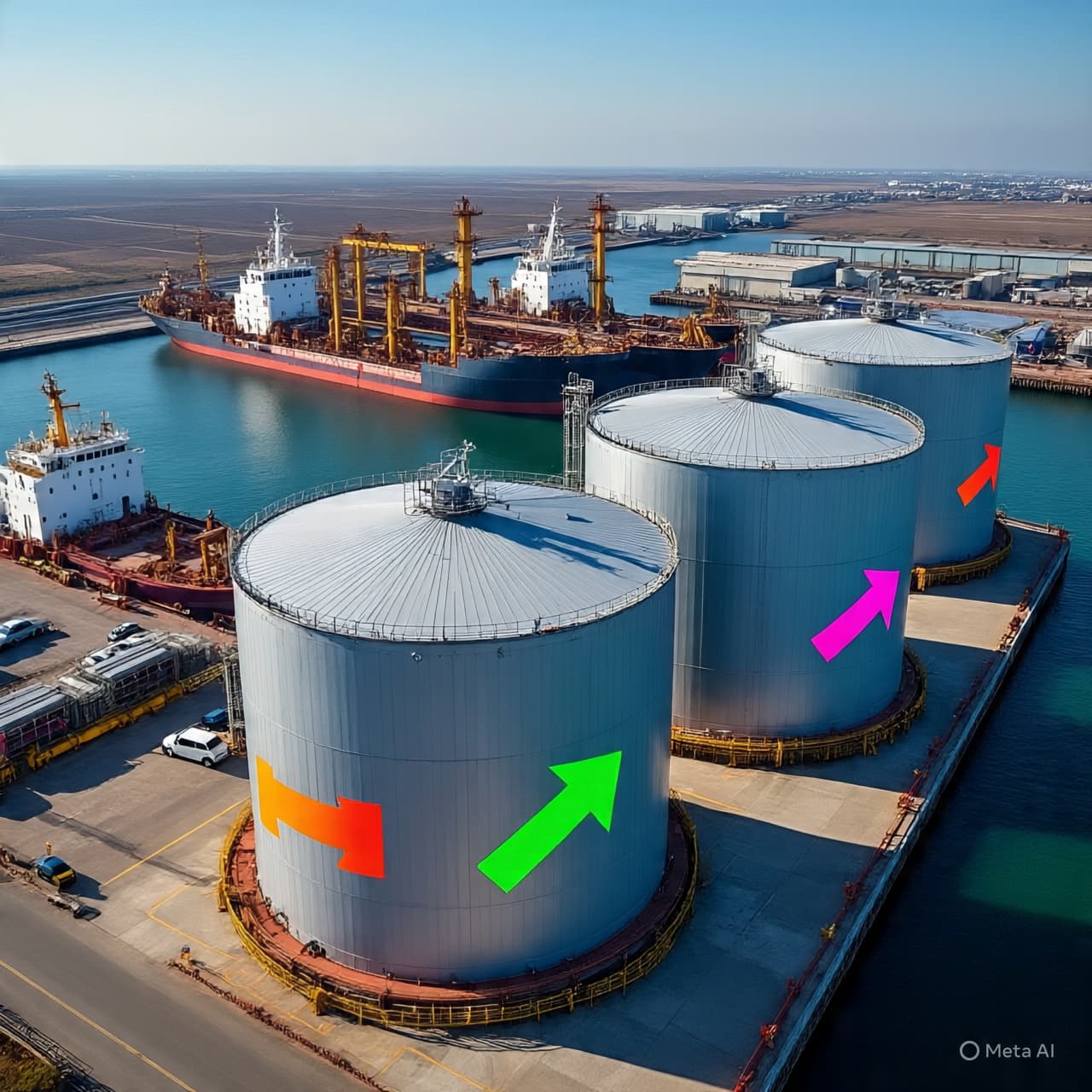

The Strait of Hormuz — a narrow maritime corridor carrying a significant share of the world’s seaborne oil — often stands symbolically at the crossroads of global energy markets. When tensions ripple through the region, even without direct disruptions to tanker traffic, oil prices can reflect a risk premium that traders build into contracts, anticipating potential shortages. This interplay between geopolitical perception and physical supply lent an undercurrent of restlessness to markets.

Yet market dynamics are rarely defined by a single story. In the days immediately following these price gains, investors and analysts noted signs of easing diplomatic strains, including remarks suggesting renewed dialogue between Washington and Tehran. Such comments helped temper earlier spikes, and prices occasionally retraced gains as speculative risk premiums softened. This ebb and flow — like wind on water — underscores how expectations, as much as supply data, shape the contours of oil trading.

Inventory shifts added another layer to this narrative. A drop in U.S. crude stockpiles — often interpreted as a sign of stronger demand or weaker supply — brought fresh attention to the physical side of the market. When inventories contract, the sense of immediacy around supply tightness can support higher prices even without long-term fundamental shifts. Together with geopolitical concerns, this inventory picture helped sustain a backdrop of cautious optimism among traders that current price levels were justified by real conditions.

In the broader scheme, oil markets reflect more than barrels bought and sold; they capture global sentiment on growth, risk, and cooperation. As governments and energy actors weigh diplomatic efforts with strategic interests, markets remain attentive to each nuance — whether in a naval skirmish, a comment from a negotiator, or the weekly tally of inventory data. Here too, the story of oil becomes a quiet chronicle of how uncertainty and hope coexist in a world where energy underpins so much of daily life.

In the latest trading sessions, Brent and U.S. crude benchmarks extended gains amid these tensions, though volatility remains evident as news cycles shift between escalation and de-escalation narratives. Compared with earlier peaks reached late January, prices now reflect both the lingering influence of geopolitical risk and the impact of supply indicators such as inventory declines. As markets digest these signals, traders and analysts alike continue to watch for further developments that could shape oil’s trajectory in the weeks ahead.

AI Image Disclaimer Graphics are AI-generated and intended for representation, not reality.

Sources Bloomberg News Reuters The Edge Malaysia Market News Aggregates