There is a peculiar moment in finance when whispers feel like wind across a still sea — barely moving at first, but visible in every ripple on the surface. As global markets opened this week, Bitcoin seemed to catch just such a breeze, rising gently above the $90,000 mark as if listening to distant currents. Traders and observers alike found themselves peering at more than price charts; they were tracing the outlines of an unfolding story that blended geopolitics, rumor, and the age-old search for value.

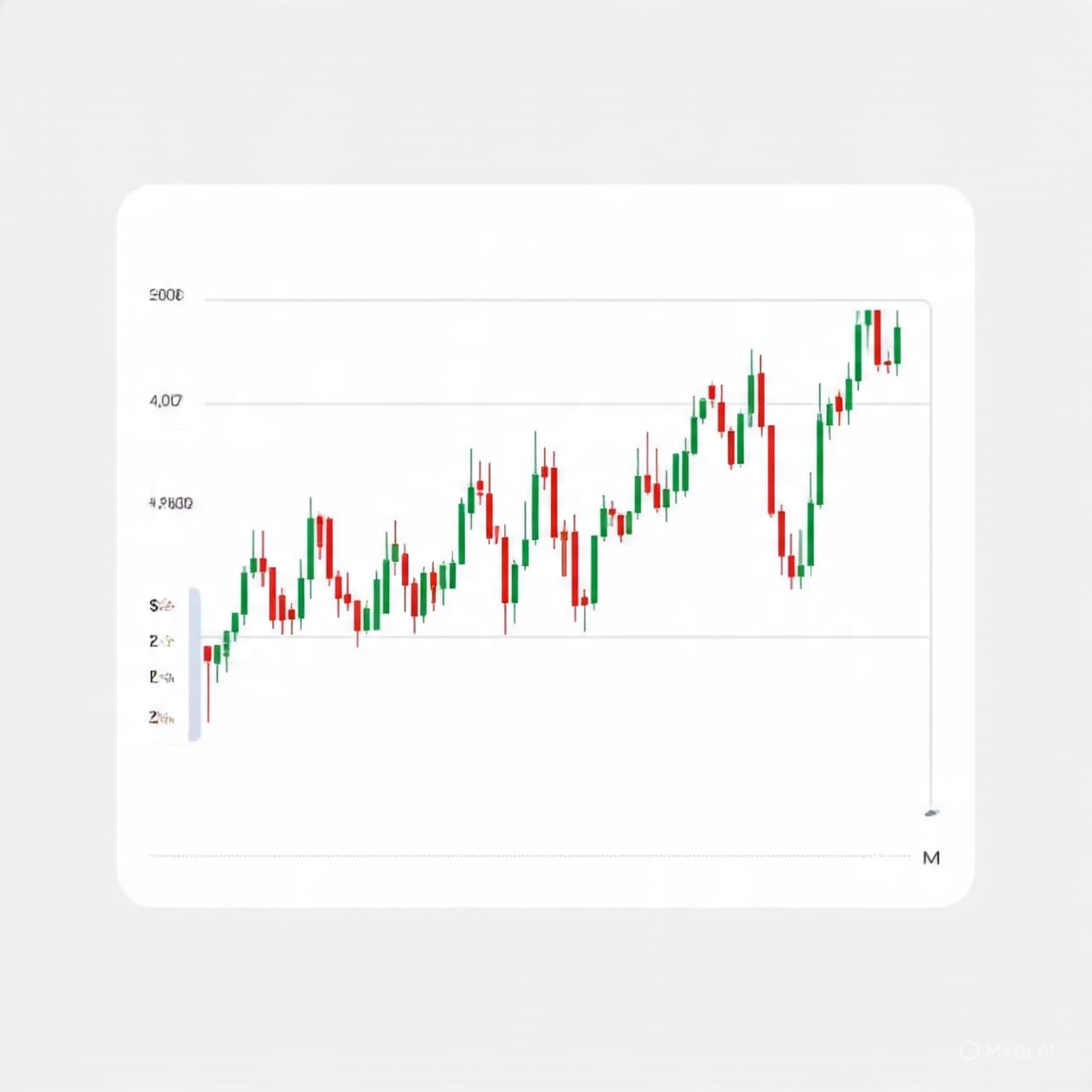

In that reflective space between fact and speculation, markets often take on an almost poetic rhythm. Bitcoin’s recent uptick, according to several market reports, came as news broke of U.S. operations involving Venezuelan leaders — an event with implications stretching beyond geopolitics into the realm of capital flows and risk assets. The cryptocurrency’s price advance coincided with broader gains in digital-asset stocks and renewed institutional interest, suggesting investors are once again tuning in to Bitcoin’s narrative as both financial instrument and cultural signal.

Yet beneath this surface movement lies a softer, murkier current: rumors of a so-called “shadow reserve” of Bitcoin allegedly held by Venezuela, possibly amounting to hundreds of thousands of coins. If true, this cache would be among the largest known outside of established institutional holders. Analysts and intelligence reports suggest this reserve may have been built over years through complex methods, including gold sales and stablecoin settlements — though blockchain evidence remains far less conclusive.

Markets, in their collective wisdom, often price in uncertainty before certainty arrives. That seems to be the case now, with Bitcoin’s price behavior showing a calmness amid geopolitical tension and renewed inflows into exchange-traded products. On-chain data points to traders remaining composed rather than panicked, even as narratives twist and turn across headlines and social platforms.

Stories like these remind us that financial markets are not just charts and statistics but threads in a broader tapestry of human belief and behavior. Each price movement carries echoes of sentiment, expectation, and sometimes sheer wonder at the scale of what may or may not be real. In the end, whether the rumored reserves ever materialize in verifiable reality may matter less than what those rumors say about how we see risk, value, and stability in a rapidly changing world.

As the week drew on, Bitcoin continued to hold its gains quietly above recent ranges, leaving traders and readers with an intriguing blend of numbers and narratives — a reminder that in the dance between certainty and speculation, markets sometimes choose rhythm over reason.

AI Image Disclaimer “Visuals are created with AI tools and are not real photographs.”

Credible sources found on this topic today:

Investor’s Business Daily – Bitcoin price up amid Venezuela operation & rumors. Yahoo! Finance – Crypto stocks and Bitcoin hitting multi-week highs. FXStreet – Bitcoin price extends gains despite geopolitical risks. Investopedia – Analysis of Bitcoin’s climb after U.S. capture of Maduro. Coinpedia / Other crypto outlets – Reports on Venezuela’s alleged large BTC holdings.